- We will send in 10–14 business days.

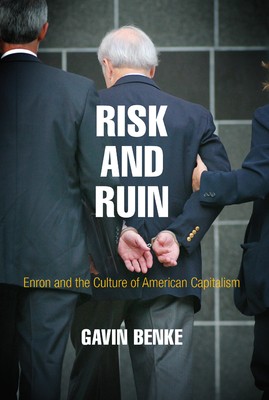

- Author: Gavin Benke

- Publisher: University of Pennsylvania Press

- ISBN-10: 0812250206

- ISBN-13: 9780812250206

- Format: 16 x 23.4 x 2.5 cm, hardcover

- Language: English

- SAVE -10% with code: EXTRA

Reviews

Description

At the time of its collapse in 2001, Enron was one of the largest companies in the world, boasting revenue of over $100 billion. During the 1990s economic boom, the Houston, Texas-based energy company had diversified into commodities and derivatives trading and many other ventures--some more legal than others. In the lead-up to Enron's demise, it was revealed that the company's financial success was sustained by a creatively planned and well-orchestrated accounting fraud. The story of Enron and its disastrous aftermath has since become a symbol of corporate excess and negligence, framed as an exceptional event in the annals of American business.

With Risk and Ruin, Gavin Benke places Enron's fall within the larger history and culture of late twentieth-century American capitalism. In many ways, Benke argues, Enron was emblematic of the transitions that characterized the era. Like Enron, the American economy had shifted from old industry to the so-called knowledge economy, from goods to finance, and from national to global modes of production. Benke dives deep into the Enron archives, analyzing company newsletters, board meeting minutes, and courtroom transcriptions to chart several interconnected themes across Enron's history: the changing fortunes of Houston; the shifting attitudes toward business strategy, deregulation, and the function of the market among policy makers and business leaders; and the cultural context that accompanied and encouraged these broader political and economic changes. Considered against this backdrop, Enron takes on new significance as a potent reminder of the unaddressed issues still facing national and global economies. Published in cooperation with the William P. Clements Center for Southwest Studies at Southern Methodist University.EXTRA 10 % discount with code: EXTRA

The promotion ends in 18d.04:40:39

The discount code is valid when purchasing from 10 €. Discounts do not stack.

- Author: Gavin Benke

- Publisher: University of Pennsylvania Press

- ISBN-10: 0812250206

- ISBN-13: 9780812250206

- Format: 16 x 23.4 x 2.5 cm, hardcover

- Language: English English

At the time of its collapse in 2001, Enron was one of the largest companies in the world, boasting revenue of over $100 billion. During the 1990s economic boom, the Houston, Texas-based energy company had diversified into commodities and derivatives trading and many other ventures--some more legal than others. In the lead-up to Enron's demise, it was revealed that the company's financial success was sustained by a creatively planned and well-orchestrated accounting fraud. The story of Enron and its disastrous aftermath has since become a symbol of corporate excess and negligence, framed as an exceptional event in the annals of American business.

With Risk and Ruin, Gavin Benke places Enron's fall within the larger history and culture of late twentieth-century American capitalism. In many ways, Benke argues, Enron was emblematic of the transitions that characterized the era. Like Enron, the American economy had shifted from old industry to the so-called knowledge economy, from goods to finance, and from national to global modes of production. Benke dives deep into the Enron archives, analyzing company newsletters, board meeting minutes, and courtroom transcriptions to chart several interconnected themes across Enron's history: the changing fortunes of Houston; the shifting attitudes toward business strategy, deregulation, and the function of the market among policy makers and business leaders; and the cultural context that accompanied and encouraged these broader political and economic changes. Considered against this backdrop, Enron takes on new significance as a potent reminder of the unaddressed issues still facing national and global economies. Published in cooperation with the William P. Clements Center for Southwest Studies at Southern Methodist University.

Reviews