- We will send in 10–14 business days.

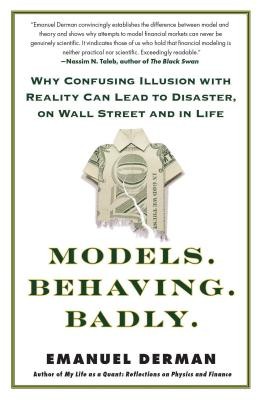

- Author: Emanuel Derman

- Publisher: Free Press

- ISBN-10: 1439164991

- ISBN-13: 9781439164990

- Format: 14.1 x 21.5 x 1.9 cm, softcover

- Language: English

- SAVE -10% with code: EXTRA

Reviews

Description

Now in paperback, "a compelling, accessible, and provocative piece of work that forces us to question many of our assumptions" (Gillian Tett, author of Fool's Gold). Quants, physicists working on Wall Street as quantitative analysts, have been widely blamed for triggering financial crises with their complex mathematical models. Their formulas were meant to allow Wall Street to prosper without risk. But in this penetrating insider's look at the recent economic collapse, Emanuel Derman--former head quant at Goldman Sachs--explains the collision between mathematical modeling and economics and what makes financial models so dangerous. Though such models imitate the style of physics and employ the language of mathematics, theories in physics aim for a description of reality--but in finance, models can shoot only for a very limited approximation of reality. Derman uses his firsthand experience in financial theory and practice to explain the complicated tangles that have paralyzed the economy. Models.Behaving.Badly. exposes Wall Street's love affair with models, and shows us why nobody will ever be able to write a model that can encapsulate human behavior.- Author: Emanuel Derman

- Publisher: Free Press

- ISBN-10: 1439164991

- ISBN-13: 9781439164990

- Format: 14.1 x 21.5 x 1.9 cm, softcover

- Language: English English

Reviews